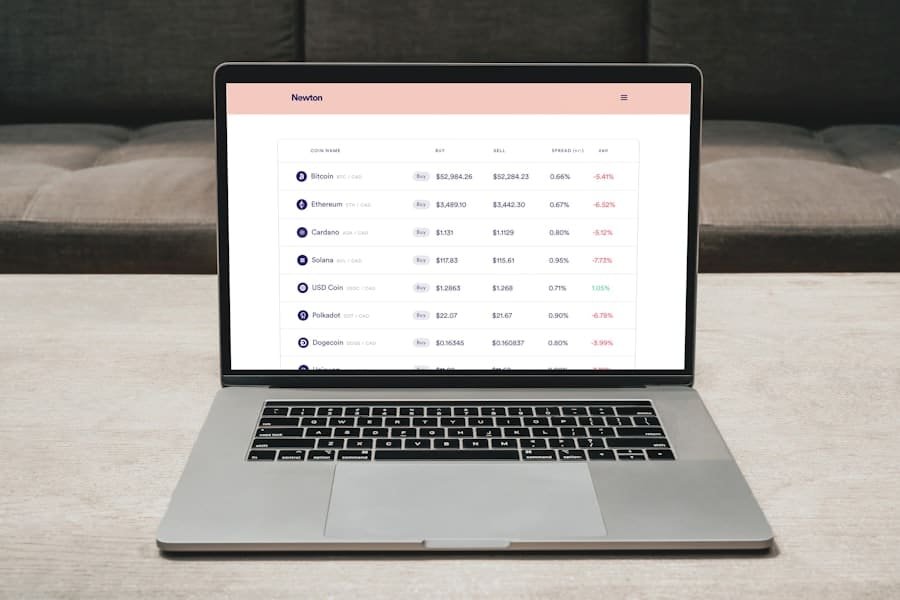

Financial instruments are tradable assets that include stocks, bonds, options, and futures. These instruments serve various purposes, such as generating income, mitigating risk, or speculating on future price movements. A comprehensive understanding of different financial instruments is essential for investors seeking to create a well-diversified portfolio.

Stocks represent ownership shares in a company and can provide capital appreciation and dividend income. Bonds are debt securities that offer interest payments and return the principal amount upon maturity. Options grant the holder the right, but not the obligation, to buy or sell an underlying asset at a specified price within a predetermined timeframe.

Futures contracts obligate the buyer to purchase an asset, or the seller to sell an asset, at a predetermined price and date. Investors should thoroughly comprehend the characteristics and risks associated with each type of financial instrument before incorporating them into their investment strategy. A clear understanding of how each instrument functions enables investors to make informed decisions regarding capital allocation and risk management.

Key Takeaways

- Financial instruments include stocks, bonds, mutual funds, and derivatives, and are essential for investment and risk management.

- Portfolio diversification is important to reduce risk by spreading investments across different asset classes and industries.

- Evaluating the risk and return of financial instruments helps investors make informed decisions and manage their portfolios effectively.

- Correlation and diversification benefits help investors understand how different assets in their portfolio interact with each other.

- Factors to consider when selecting financial instruments include investment goals, risk tolerance, and time horizon.

- Monitoring and rebalancing the portfolio is crucial to ensure that the asset allocation remains in line with the investor’s objectives and risk tolerance.

- Best practices for using financial instruments in portfolio diversification include thorough research, regular monitoring, and seeking professional advice when needed.

Importance of Portfolio Diversification

Reducing Risk through Diversification

This is because different assets tend to perform differently under various market conditions. For example, during periods of economic growth, stocks may outperform bonds, while during economic downturns, bonds may provide more stability.

Achieving Consistent Returns

By holding a mix of stocks, bonds, and other financial instruments, investors can potentially achieve a more consistent return over time. Diversification can also help investors capture the benefits of different market trends.

Capitalizing on Market Dynamics

For instance, when one asset class is underperforming, another may be experiencing growth. By diversifying their portfolio, investors can take advantage of these market dynamics and potentially enhance their overall returns.

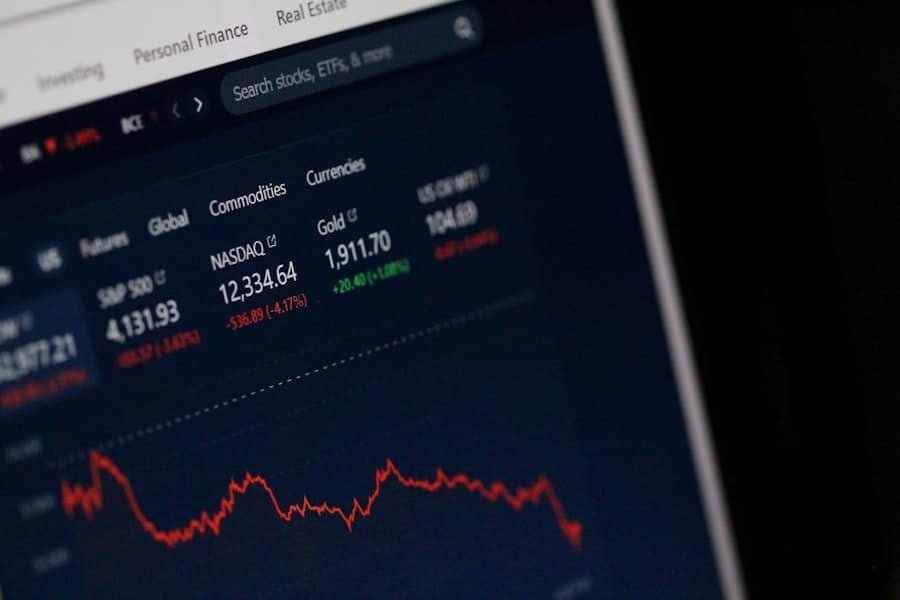

Evaluating the Risk and Return of Financial Instruments

When evaluating financial instruments for inclusion in a portfolio, it’s important for investors to consider both the potential risk and return associated with each instrument. Different financial instruments carry different levels of risk and potential return, so it’s crucial to assess these factors before making investment decisions. Stocks, for example, are generally considered to have higher potential returns but also come with higher volatility and risk.

Bonds, on the other hand, are typically less volatile but offer lower potential returns. Options and futures can carry even higher levels of risk due to their leverage and complexity. Investors should carefully evaluate the risk-return profile of each financial instrument and consider how it aligns with their investment objectives and risk tolerance.

By understanding the potential risks and returns associated with each instrument, investors can make more informed decisions about how to construct a well-balanced and diversified portfolio.

Correlation and Diversification Benefits

Correlation refers to the degree to which the prices of different financial instruments move in relation to each other. When two assets have a high positive correlation, they tend to move in the same direction, while assets with a negative correlation move in opposite directions. Understanding the correlation between different financial instruments is crucial for achieving effective portfolio diversification.

By including assets with low or negative correlations in a portfolio, investors can potentially reduce overall portfolio risk. This is because when one asset is underperforming, another may be performing well, helping to offset losses and stabilize overall portfolio returns. For example, during periods of stock market volatility, bonds often exhibit negative correlation with stocks, providing a buffer against equity market downturns.

By including both stocks and bonds in a portfolio, investors can potentially achieve a more stable overall return.

Factors to Consider When Selecting Financial Instruments

When selecting financial instruments for inclusion in a portfolio, investors should consider a range of factors to ensure they align with their investment objectives and risk tolerance. Some key factors to consider include the investment time horizon, liquidity, tax implications, and fees associated with each instrument. The investment time horizon refers to the length of time an investor expects to hold an investment before needing to access their capital.

For long-term investors, assets with higher potential returns but also higher volatility may be suitable, while short-term investors may prefer more stable and liquid assets. Liquidity is another important factor to consider when selecting financial instruments. Liquid assets can be easily bought or sold without significantly impacting their market price.

Illiquid assets, on the other hand, may be more difficult to sell quickly without incurring significant costs or price discounts. Tax implications should also be taken into account when selecting financial instruments. Different types of investments may have varying tax treatments, so it’s important for investors to consider how taxes will impact their overall returns.

Finally, investors should carefully evaluate the fees associated with each financial instrument. Fees can erode investment returns over time, so it’s important to consider the impact of fees when selecting investments for a portfolio.

Monitoring and Rebalancing the Portfolio

Preventing Drift from Target Allocation

Once a diversified portfolio has been constructed, it’s essential for investors to regularly monitor its performance and rebalance as needed. Market fluctuations and changes in asset values can cause a portfolio to deviate from its target asset allocation over time. By regularly monitoring their portfolio, investors can identify when it’s necessary to rebalance by buying or selling assets to bring their portfolio back in line with their target allocation.

Maintaining Diversification and Risk Exposure

Rebalancing allows investors to maintain their desired level of diversification and risk exposure. Additionally, monitoring the performance of individual financial instruments within the portfolio can help investors identify when it may be appropriate to make changes. For example, if a particular asset is consistently underperforming or exhibiting higher volatility than expected, it may be necessary to reassess its role in the portfolio.

Staying Aligned with Investment Objectives

By staying actively engaged with their portfolio and making adjustments as needed, investors can ensure that their portfolio remains aligned with their investment objectives and risk tolerance over time.

Best Practices for Using Financial Instruments in Portfolio Diversification

In conclusion, understanding financial instruments and their characteristics is essential for building a well-diversified portfolio. By incorporating a mix of stocks, bonds, options, futures, and other financial instruments, investors can potentially achieve more consistent returns and reduce overall portfolio risk. When selecting financial instruments for inclusion in a portfolio, it’s important for investors to carefully evaluate the potential risks and returns associated with each instrument.

Considering factors such as correlation, liquidity, tax implications, and fees can help investors make informed decisions about how to construct a well-balanced portfolio that aligns with their investment objectives and risk tolerance. Finally, regularly monitoring and rebalancing the portfolio is crucial for maintaining effective diversification over time. By staying actively engaged with their investments and making adjustments as needed, investors can ensure that their portfolio remains well-diversified and aligned with their long-term financial goals.

If you’re interested in learning more about the use of financial instruments in portfolio diversification, you may want to check out this article on The Econosphere’s blog. The article discusses the benefits of using options and futures to hedge against market risk and enhance portfolio returns. It provides valuable insights into how these financial instruments can be effectively utilized in a diversified investment strategy.

FAQs

What are financial instruments?

Financial instruments are assets that can be traded, such as stocks, bonds, options, and futures contracts. They can also include cash and cash equivalents.

What is portfolio diversification?

Portfolio diversification is a risk management strategy that involves spreading investments across different asset classes and securities to reduce the overall risk of the portfolio.

How can financial instruments be used in portfolio diversification?

Financial instruments can be used in portfolio diversification by including a mix of different asset classes, such as stocks, bonds, and commodities, as well as different types of securities within each asset class.

What are the benefits of using financial instruments in portfolio diversification?

Using financial instruments in portfolio diversification can help reduce the overall risk of the portfolio, increase potential returns, and provide exposure to different market sectors and investment opportunities.

What are some common financial instruments used in portfolio diversification?

Common financial instruments used in portfolio diversification include stocks, bonds, mutual funds, exchange-traded funds (ETFs), options, and futures contracts.

What are some considerations when evaluating the use of financial instruments in portfolio diversification?

When evaluating the use of financial instruments in portfolio diversification, it is important to consider the risk-return tradeoff, correlation between different assets, liquidity, and the investor’s risk tolerance and investment objectives.