The availability heuristic is a cognitive shortcut that influences decision-making and judgment based on the ease with which examples come to mind. This mental process leads individuals to overestimate the probability of events that are more readily accessible in their memory. People tend to perceive easily recalled information as more common or significant.

Recent events, emotionally charged experiences, and easily accessible information often shape this heuristic. A common manifestation of the availability heuristic is the overestimation of rare but highly publicized events, such as airplane crashes or shark attacks. Extensive media coverage of these incidents makes them more memorable, causing people to perceive them as more frequent than they actually are.

Another example is when individuals base their judgments about event frequency on personal experiences. For instance, knowing several people involved in car accidents may lead to an overestimation of overall car accident likelihood. This cognitive bias has significant implications for businesses and investors, as it can impact decision-making processes and market behavior.

Various factors can influence the availability heuristic, including media coverage, personal experiences, and cultural influences. Constant exposure to negative news about crime may lead individuals to overestimate their likelihood of becoming crime victims. Similarly, personal experiences with specific products or services may disproportionately influence decision-making, even if these experiences are not representative of the general population.

Recognizing the potential for biased judgments resulting from the availability heuristic is crucial, as it can affect various aspects of an individual’s life and decision-making processes.

Key Takeaways

- The availability heuristic is a mental shortcut that relies on immediate examples that come to mind when evaluating a specific topic or making a decision.

- The availability heuristic can influence consumer decision making by making certain products or brands more salient and easily accessible in the mind, leading to biased choices.

- When it comes to investment choices, the availability heuristic can lead investors to overvalue familiar or recent information, potentially leading to suboptimal investment decisions.

- In stock market behavior, the availability heuristic can lead to overreaction to recent news or events, causing stock prices to fluctuate more than they should based on fundamental factors.

- Marketers can leverage the availability heuristic by making their products or brands more mentally accessible to consumers through strategic advertising and branding efforts.

The Impact of Availability Heuristic on Consumer Decision Making

Influencing Perceptions of Risk

When consumers rely on the availability heuristic, they may overestimate the likelihood of negative outcomes associated with a product or service based on easily recalled instances or vivid information. For example, if a consumer hears about a few cases of product defects or recalls, they may perceive the product as being more risky or unreliable than it actually is. This can lead to a decrease in demand for the product, even if the instances of defects are rare in comparison to the total number of units sold.

Shaping Consumer Preferences

The availability heuristic can influence consumer preferences by making certain products or brands more salient and memorable. For example, if a consumer sees frequent advertisements for a particular brand of soda, they may be more likely to choose that brand when making a purchase, even if there are other options available. This can lead to an increase in market share for the advertised brand, as it becomes more readily available in the consumer’s memory.

Impact on Purchasing Behavior

Furthermore, the availability heuristic can impact purchasing behavior by influencing perceptions of scarcity and demand. If a product is frequently out of stock or in high demand, consumers may perceive it as being more valuable and desirable, leading to increased purchasing behavior. In conclusion, the availability heuristic has a profound impact on consumer decision making by influencing perceptions of risk, preferences, and purchasing behavior. Businesses must be aware of this cognitive bias and take steps to mitigate its effects in order to effectively market their products and services.

How Availability Heuristic Affects Investment Choices

The availability heuristic also plays a significant role in investment choices, as it can influence perceptions of risk and return associated with different investment options. When investors rely on the availability heuristic, they may overestimate the likelihood of certain outcomes based on easily recalled instances or vivid information. For example, if an investor hears about a few high-profile investment successes in a particular industry, they may perceive that industry as being more lucrative and less risky than it actually is.

This can lead to an increase in investment in that industry, even if the instances of success are rare in comparison to the total number of investments made. Additionally, the availability heuristic can influence investment choices by making certain assets or investment strategies more salient and memorable. For example, if an investor sees frequent news stories about successful stock picks or investment strategies, they may be more likely to choose those options when making investment decisions, even if there are other options available.

This can lead to an increase in demand for certain assets or strategies, as they become more readily available in the investor’s memory. Furthermore, the availability heuristic can impact investment behavior by influencing perceptions of market trends and performance. If a particular asset class or investment strategy is frequently discussed in the media or among peers, investors may perceive it as being more attractive and profitable, leading to increased investment behavior.

In conclusion, the availability heuristic has a profound impact on investment choices by influencing perceptions of risk and return associated with different investment options. Investors must be aware of this cognitive bias and take steps to mitigate its effects in order to make informed and rational investment decisions.

The Role of Availability Heuristic in Stock Market Behavior

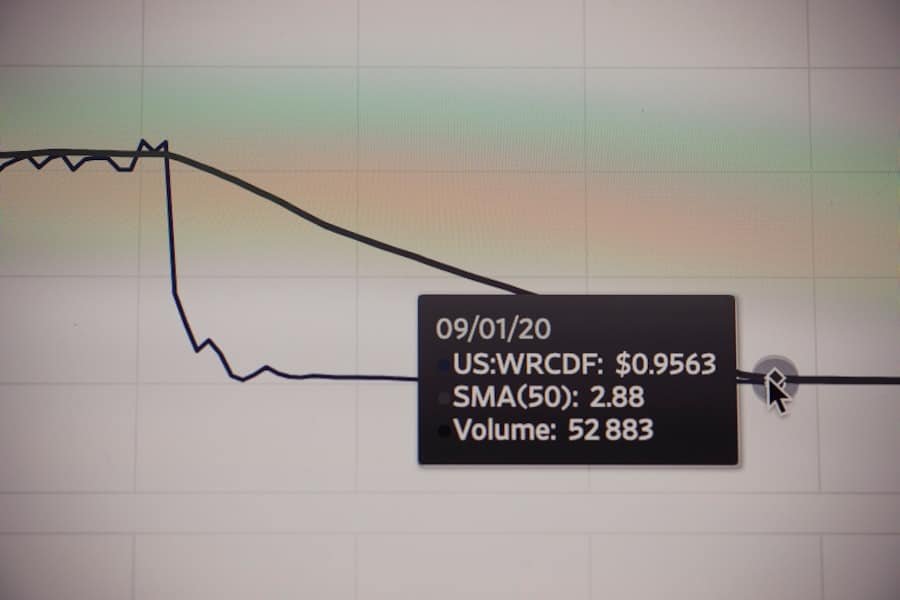

The availability heuristic also plays a significant role in stock market behavior, as it can influence perceptions of market trends, stock performance, and investment opportunities. When market participants rely on the availability heuristic, they may overestimate the likelihood of certain outcomes based on easily recalled instances or vivid information. For example, if investors hear about a few high-profile stock market successes in a particular sector, they may perceive that sector as being more lucrative and less risky than it actually is.

This can lead to an increase in demand for stocks in that sector, even if the instances of success are rare in comparison to the total number of stocks traded. Additionally, the availability heuristic can influence stock market behavior by making certain stocks or sectors more salient and memorable. For example, if investors see frequent news stories about successful stock picks or market trends, they may be more likely to invest in those stocks or sectors, even if there are other options available.

This can lead to an increase in demand for certain stocks or sectors, as they become more readily available in the investor’s memory. Furthermore, the availability heuristic can impact stock market behavior by influencing perceptions of market volatility and performance. If a particular stock or sector is frequently discussed in the media or among peers, investors may perceive it as being more attractive and profitable, leading to increased trading activity.

In conclusion, the availability heuristic has a profound impact on stock market behavior by influencing perceptions of market trends, stock performance, and investment opportunities. Market participants must be aware of this cognitive bias and take steps to mitigate its effects in order to make informed and rational investment decisions.

Assessing the Influence of Availability Heuristic on Marketing Strategies

The availability heuristic has a significant influence on marketing strategies as it affects consumer perceptions and decision-making processes. Marketers must understand how this cognitive bias impacts consumer behavior in order to develop effective marketing strategies that resonate with their target audience. When consumers rely on the availability heuristic, they may overestimate the likelihood of certain outcomes based on easily recalled instances or vivid information.

This can lead to biased perceptions of products or brands, affecting their purchasing decisions. Marketers can leverage the availability heuristic by creating memorable and salient marketing campaigns that make their products or brands more readily available in consumers’ memory. By using vivid imagery, emotional storytelling, and frequent exposure through various channels, marketers can increase the salience of their products or brands in consumers’ minds.

Additionally, marketers can use social proof and testimonials to make positive experiences with their products more accessible and memorable to consumers. By understanding how the availability heuristic influences consumer decision making, marketers can tailor their strategies to effectively capture consumers’ attention and drive purchasing behavior. Furthermore, marketers must be mindful of how negative information or experiences can disproportionately impact consumer perceptions due to the availability heuristic.

By addressing potential concerns and proactively managing negative publicity through transparent communication and effective crisis management strategies, marketers can mitigate the impact of negative availability bias on consumer perceptions. Overall, understanding and leveraging the availability heuristic is crucial for marketers to develop successful marketing strategies that resonate with consumers and drive positive brand perceptions.

Overcoming the Pitfalls of Availability Heuristic in Market Behavior

Diversifying Information Sources

One approach is to diversify information sources and seek out balanced perspectives when making decisions. By exposing themselves to a wide range of information and viewpoints, individuals can reduce the impact of biased recall and vivid information on their judgments. This can help investors make more informed investment choices and businesses develop marketing strategies that are not solely reliant on salience and memorability.

Systematic Decision-Making Processes

Another strategy for overcoming the pitfalls of availability heuristic is to engage in deliberate and systematic decision-making processes that consider all relevant factors and data points. By using analytical tools and decision frameworks that account for various sources of information and probabilities, individuals can reduce the influence of biased recall on their decisions. This approach can help investors make rational investment choices based on comprehensive analysis rather than relying solely on easily recalled instances or vivid information.

Providing Accurate and Transparent Information

Furthermore, businesses can mitigate the impact of availability heuristic on consumer behavior by providing accurate and transparent information about their products or services. By proactively addressing potential concerns and providing balanced representations of their offerings, businesses can counteract the effects of biased recall and negative salience on consumer perceptions. Additionally, businesses can leverage positive experiences and social proof to make favorable instances more accessible and memorable to consumers.

In conclusion, overcoming the pitfalls of availability heuristic in market behavior requires deliberate efforts to diversify information sources, engage in systematic decision-making processes, and provide accurate and transparent information to consumers. By employing these strategies, businesses and investors can mitigate the influence of biased recall and vivid information on decision-making processes.

Implications for Businesses and Investors: Navigating the Availability Heuristic

The implications of availability heuristic for businesses and investors are significant as it impacts decision making processes across various domains. Businesses must recognize how this cognitive bias influences consumer behavior and develop marketing strategies that effectively navigate its influence. By leveraging salience and memorability through impactful storytelling, branding initiatives, and positive experiences with their products or services, businesses can capture consumers’ attention and drive purchasing behavior.

However, businesses must also be mindful of how negative information or experiences can disproportionately impact consumer perceptions due to availability bias. For investors, understanding how availability heuristic influences investment choices is crucial for making informed decisions and managing portfolio risks effectively. By diversifying information sources, engaging in systematic decision-making processes, and seeking out balanced perspectives when evaluating investment opportunities, investors can mitigate the impact of biased recall on their judgments.

Additionally, investors must be mindful of how media coverage and market trends can influence perceptions of risk and return associated with different investment options. Overall, navigating the implications of availability heuristic requires businesses and investors to be aware of its influence on decision making processes and employ strategies that mitigate its effects. By understanding how this cognitive bias shapes perceptions and judgments, businesses can develop effective marketing strategies that resonate with consumers while investors can make informed investment choices based on comprehensive analysis rather than biased recall or vivid information.

If you’re interested in learning more about how cognitive biases impact economic decision-making, check out this article on The Econosphere’s blog. The article discusses the influence of availability heuristic on market behavior and provides valuable insights into how individuals and businesses can make more informed choices in the marketplace. Check it out here for a deeper understanding of this important topic.

FAQs

What is the availability heuristic?

The availability heuristic is a mental shortcut that relies on immediate examples that come to a person’s mind when evaluating a specific topic, concept, method, or decision.

How does the availability heuristic affect market behavior?

The availability heuristic can influence market behavior by causing individuals to overestimate the likelihood of events or outcomes that are easily recalled from memory, such as recent news or personal experiences.

What are some examples of the availability heuristic in market behavior?

Examples of the availability heuristic in market behavior include investors being influenced by recent market trends or news events, consumers being swayed by memorable advertising campaigns, and individuals making decisions based on easily accessible information rather than a comprehensive analysis.

How can the effects of the availability heuristic on market behavior be assessed?

The effects of the availability heuristic on market behavior can be assessed through empirical studies, behavioral experiments, and analysis of market trends and decision-making patterns. Researchers may also use surveys and interviews to gather insights into how individuals perceive and respond to information availability in the market.

What are the potential implications of the availability heuristic on market behavior?

The availability heuristic can lead to biased decision-making, herd behavior, and market inefficiencies. It may also contribute to the amplification of market volatility and the formation of bubbles or panics. Understanding and mitigating the effects of the availability heuristic is important for promoting rational and efficient market behavior.