Financial crises are severe disruptions in financial markets characterized by sharp declines in asset prices, failures of financial institutions, and significant contractions in economic activity. These events can be triggered by various factors, including excessive risk-taking, asset bubbles, and external shocks such as geopolitical events or natural disasters. The consequences of financial crises extend beyond the financial sector, impacting the real economy and leading to widespread unemployment, increased poverty, and social instability.

Throughout history, financial crises have been a recurring phenomenon in the global economy. Notable examples include the Great Depression of the 1930s, the Asian financial crisis of 1997, and the global financial crisis of 2008. These events have had profound and enduring effects on the affected economies, influencing their economic trajectories for extended periods.

Comprehending the short-term and long-term economic impacts of financial crises is essential for policymakers and economists. This understanding enables them to develop effective strategies for mitigating the negative effects of such crises and promoting sustainable economic recovery.

Key Takeaways

- Financial crises can have significant short-term and long-term impacts on the economy

- Short-term impacts include decreased consumer and business spending, increased unemployment, and reduced economic growth

- Long-term impacts can include lower productivity, decreased investment, and increased government debt

- Factors affecting long-term economic recovery include the severity of the crisis, government policies, and global economic conditions

- Policy responses to mitigate long-term effects can include fiscal stimulus, monetary policy adjustments, and financial sector reforms

Short-Term Economic Impact of Financial Crises

The Contraction of Economic Activity

The reduction in economic activity leads to a rise in unemployment and a decline in household incomes, which in turn exacerbates social inequality and poverty. Furthermore, the collapse of financial institutions disrupts the flow of credit to businesses and households, further exacerbating the economic downturn.

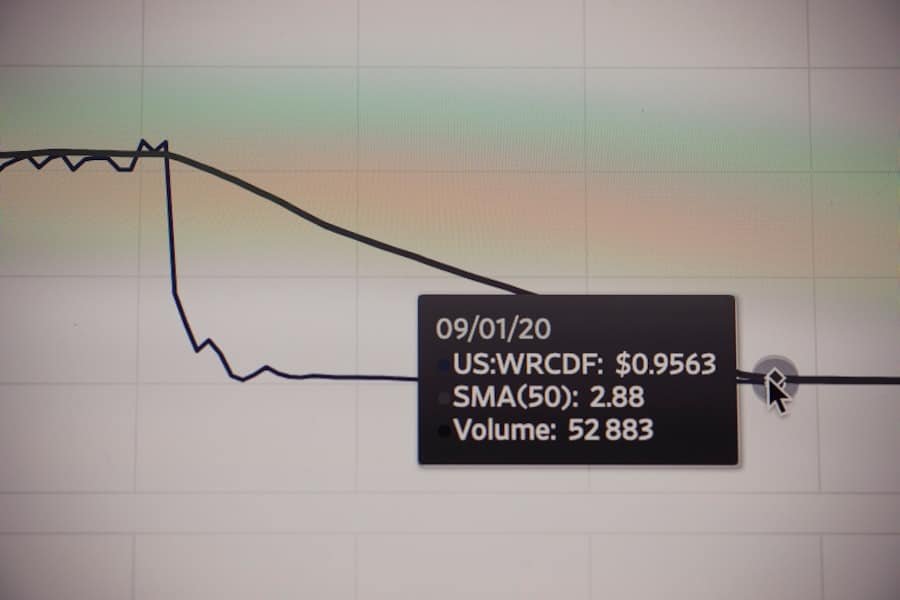

The Impact on Financial Markets

During financial crises, stock markets often experience sharp declines, leading to a decline in household wealth and a negative wealth effect that further depresses consumer spending. The housing market may also experience a sharp correction, leading to a decline in construction activity and a rise in mortgage defaults.

Government Response and Long-Term Consequences

In response to financial crises, governments often implement expansionary fiscal and monetary policies to stimulate economic activity. This may involve cutting interest rates, increasing government spending, and providing liquidity support to the financial sector. However, these measures may take time to have an impact on the real economy, and the short-term economic impact of financial crises can be severe and long-lasting.

Long-Term Economic Impact of Financial Crises

The long-term economic impact of financial crises can be profound, shaping the economic trajectory of affected economies for years or even decades. One of the most significant long-term effects is the erosion of human capital, as prolonged periods of unemployment and underemployment can lead to a loss of skills and experience among workers. This can have lasting effects on productivity and potential output, leading to a permanent reduction in economic growth.

Financial crises can also lead to a decline in business investment and innovation, as firms become more risk-averse and focus on cost-cutting measures rather than long-term growth strategies. This can lead to a decline in productivity growth and technological progress, further dampening long-term economic prospects. Moreover, the collapse of financial institutions can lead to a loss of trust in the financial system, making it more difficult for businesses to access credit and finance investment projects.

In addition, financial crises can have lasting effects on public finances, as governments may be forced to increase borrowing to finance bailouts and stimulus measures. This can lead to a rise in public debt levels, which may crowd out private investment and lead to higher interest rates in the long run. Moreover, the social impact of financial crises can be long-lasting, as increased poverty and inequality can lead to social unrest and political instability, further undermining long-term economic prospects.

Factors Affecting Long-Term Economic Recovery

Several factors can affect the long-term economic recovery from financial crises. One key factor is the effectiveness of policy responses in mitigating the short-term impact of the crisis and promoting sustainable economic growth. Effective fiscal and monetary policies can help stabilize the economy and restore confidence, laying the groundwork for a strong and sustained recovery.

In contrast, ineffective or poorly designed policies can prolong the economic downturn and lead to lasting damage to the economy. Another important factor is the resilience of the financial system and the extent of structural reforms implemented in response to the crisis. Strengthening financial regulation and supervision can help prevent future crises and restore trust in the financial system, promoting investment and growth.

Moreover, structural reforms aimed at improving labor market flexibility, promoting competition, and enhancing productivity can help boost long-term economic prospects and facilitate recovery. The global economic environment also plays a crucial role in shaping the long-term economic recovery from financial crises. A supportive global economic environment characterized by strong growth in major trading partners can help boost exports and investment, promoting recovery.

In contrast, a weak global economic environment characterized by trade tensions or geopolitical risks can hinder recovery efforts and prolong the economic downturn.

Policy Responses to Mitigate Long-Term Effects

Policymakers have a range of policy tools at their disposal to mitigate the long-term effects of financial crises and promote sustainable economic recovery. One key policy response is to implement structural reforms aimed at strengthening the resilience of the financial system and promoting long-term growth. This may involve enhancing financial regulation and supervision, improving corporate governance standards, and promoting competition in the financial sector.

Moreover, policymakers can implement targeted measures to support human capital development and labor market flexibility, such as investing in education and training programs and promoting flexible labor market policies. These measures can help mitigate the long-term impact of unemployment and underemployment on human capital and productivity growth. In addition, policymakers can implement measures aimed at promoting innovation and investment, such as providing incentives for research and development activities and supporting access to finance for innovative firms.

This can help boost productivity growth and technological progress, laying the groundwork for sustained economic recovery. Furthermore, policymakers can work towards creating a supportive global economic environment by promoting international cooperation and trade liberalization. This may involve working towards resolving trade tensions and geopolitical risks that could hinder global economic growth and recovery efforts.

Case Studies of Long-Term Economic Effects

Several case studies provide insights into the long-term economic effects of financial crises. For example, Japan’s experience with the “Lost Decade” following the bursting of its asset bubble in the early 1990s illustrates how prolonged periods of economic stagnation can lead to lasting damage to an economy. The collapse of asset prices led to a banking crisis and a prolonged period of deflation, which undermined consumer spending and investment for years to come.

Similarly, Greece’s experience with the sovereign debt crisis that began in 2009 highlights how high levels of public debt can lead to prolonged periods of austerity and economic hardship. The country experienced a severe economic contraction and a rise in unemployment, leading to widespread social unrest and political instability. The long-term effects of the crisis are still being felt today, with high levels of public debt continuing to weigh on economic prospects.

In contrast, South Korea’s experience with the Asian financial crisis of 1997 demonstrates how effective policy responses can promote a strong and sustained economic recovery. The country implemented structural reforms aimed at strengthening its financial system and promoting long-term growth, leading to a rapid rebound in economic activity and a return to strong growth.

Conclusion and Recommendations for Future Financial Crises

In conclusion, financial crises can have profound short-term and long-term effects on affected economies, shaping their economic trajectory for years to come. Understanding the factors affecting long-term economic recovery and implementing effective policy responses are crucial for mitigating the long-term effects of financial crises and promoting sustainable economic growth. To mitigate the long-term effects of financial crises, policymakers should focus on implementing structural reforms aimed at strengthening the resilience of the financial system, promoting human capital development, supporting innovation and investment, and creating a supportive global economic environment.

By learning from past case studies and implementing effective policy responses, economies can better prepare for future financial crises and promote sustainable economic recovery.

If you’re interested in learning more about the long-term economic effects of financial crises, you should check out the article “The Impact of Financial Crises on Economic Growth” on The Econosphere. This article delves into the various ways in which financial crises can impact a country’s economic growth over the long term, providing valuable insights into the lasting effects of such events.

FAQs

What are financial crises?

Financial crises are events in which the value of financial institutions or assets suddenly drops. This can lead to a wide range of negative economic effects, including decreased consumer and business confidence, reduced investment, and increased unemployment.

What are the long-term economic effects of financial crises?

Financial crises can have long-lasting effects on an economy. These effects can include lower economic growth, decreased productivity, increased government debt, and reduced living standards for the population.

How do financial crises impact different sectors of the economy?

Financial crises can impact different sectors of the economy in various ways. For example, the banking sector may experience increased levels of non-performing loans, while the real estate sector may see a decline in property values. Additionally, the stock market may experience increased volatility, and the overall business environment may become more uncertain.

What are some examples of financial crises and their long-term effects?

Some examples of financial crises and their long-term effects include the Great Depression of the 1930s, the Asian Financial Crisis of 1997, and the Global Financial Crisis of 2008. These events led to prolonged periods of economic hardship, including high unemployment, decreased investment, and slow economic recovery.

How can policymakers mitigate the long-term economic effects of financial crises?

Policymakers can take various measures to mitigate the long-term economic effects of financial crises. These measures may include implementing financial regulations to prevent future crises, providing stimulus packages to boost economic activity, and implementing structural reforms to improve the resilience of the economy.