Technological innovation has significantly impacted various sectors, including government operations. In recent years, governments worldwide have increasingly adopted advanced technologies to enhance their operational efficiency, improve service delivery, and optimize financial management. One crucial area where technological innovation can make a substantial difference is in government debt management.

Government debt remains a pressing concern for many nations, with high debt levels posing challenges to economic stability and growth. Consequently, developing innovative approaches to manage and reduce government debt has become a priority for policymakers. Technological advancements offer a range of tools and solutions that can assist governments in addressing their debt challenges more effectively.

These technological solutions include advanced data analytics, artificial intelligence, blockchain technology, and digital payment systems. These innovations present numerous opportunities for governments to enhance their debt management strategies. This article will examine the impact of technological innovation on government debt, exploring its potential to improve revenue generation, increase spending efficiency, and inform debt management strategies.

Additionally, the article will address potential risks and challenges associated with implementing technological innovations in government debt management. It will provide case studies of countries that have successfully utilized technology to manage their debt and deficit. Finally, the article will discuss future implications and offer recommendations for leveraging technological innovation in government debt management.

Key Takeaways

- Technological innovation has the potential to significantly impact government debt and deficit management.

- It can lead to increased government revenue through improved tax collection and compliance.

- Efficiency in government spending can be improved through the use of technological innovation, leading to better allocation of resources.

- Technological innovation can play a crucial role in debt management strategies, such as through the use of digital platforms for bond issuance and management.

- However, there are potential risks and challenges associated with technological innovation in government debt management, such as cybersecurity threats and data privacy concerns.

The Impact of Technological Innovation on Government Revenue

Enhancing Tax Collection through Technology

For example, the use of big data analytics can help governments identify patterns of tax evasion and fraud, allowing them to take targeted enforcement actions and recover lost revenue. Additionally, the use of digital payment systems and blockchain technology can streamline the tax collection process, making it easier for individuals and businesses to comply with their tax obligations.

New Revenue Streams through Technological Innovation

Furthermore, technological innovation can also create new revenue streams for governments. For instance, the rise of the digital economy has led to new opportunities for taxation, such as taxing online sales and digital services. By leveraging technology, governments can more effectively capture revenue from these sources and ensure that they are not lost due to traditional tax collection methods being unable to keep up with the pace of technological change.

Challenges and Considerations

On the other hand, it is important to note that technological innovation in revenue generation also comes with its own set of challenges. For example, the use of advanced data analytics and artificial intelligence raises concerns about data privacy and security. Governments must ensure that they are using technology in a responsible and ethical manner, respecting the privacy rights of individuals while still effectively capturing revenue. Additionally, there may be resistance from certain sectors of society to new forms of taxation related to the digital economy. Policymakers must carefully navigate these challenges to ensure that technological innovation in revenue generation is implemented in a way that is fair and equitable for all citizens.

How Technological Innovation Can Improve Government Spending Efficiency

In addition to impacting revenue generation, technological innovation also has the potential to improve government spending efficiency. By leveraging advanced data analytics and artificial intelligence, governments can better identify areas of inefficiency and waste in their spending, allowing them to make more informed decisions about resource allocation. For example, by analyzing large datasets, governments can identify patterns of spending that may indicate inefficiency or potential areas for cost savings.

This can help policymakers make more targeted and effective decisions about where to allocate resources, ensuring that taxpayer dollars are being used in the most efficient manner possible. Furthermore, technological innovation can also streamline government procurement processes, reducing administrative costs and improving transparency. For example, the use of blockchain technology in procurement can create a secure and transparent record of transactions, reducing the risk of fraud and corruption.

Additionally, digital payment systems can simplify the process of paying vendors and contractors, reducing the administrative burden on government agencies and improving overall efficiency. However, it is important to recognize that implementing technological innovation in government spending efficiency also comes with its own set of challenges. For example, there may be resistance from entrenched interests within government agencies to change traditional procurement processes or adopt new technologies.

Additionally, there may be concerns about job displacement as certain administrative tasks become automated through technological innovation. Policymakers must carefully navigate these challenges to ensure that technological innovation in spending efficiency is implemented in a way that maximizes benefits while minimizing potential negative impacts.

The Role of Technological Innovation in Debt Management Strategies

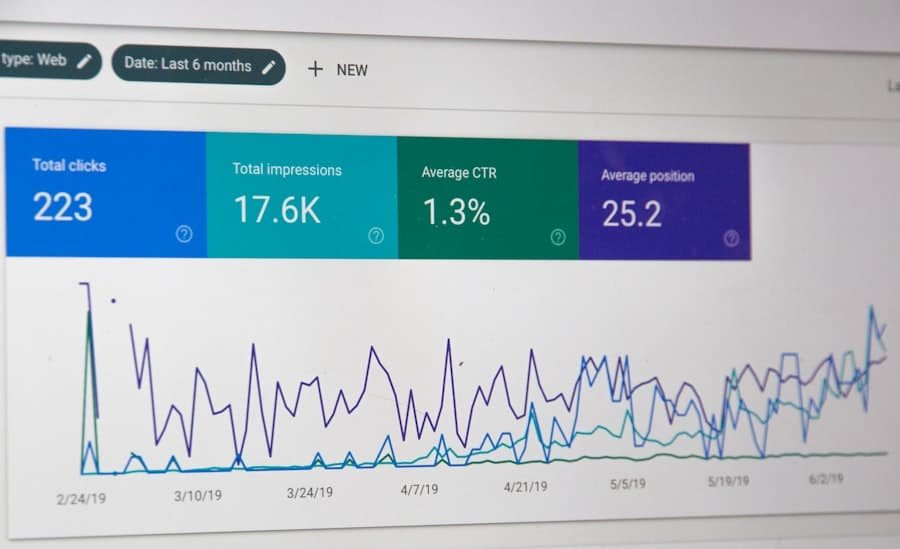

Technological innovation plays a crucial role in informing debt management strategies for governments. By leveraging advanced data analytics and artificial intelligence, governments can better understand their debt dynamics and make more informed decisions about borrowing and repayment. For example, by analyzing large datasets related to government debt, policymakers can identify trends and patterns that may indicate potential risks or opportunities for refinancing or restructuring debt.

This can help governments make more strategic decisions about managing their debt portfolio and minimizing borrowing costs. Furthermore, technological innovation can also improve transparency and accountability in debt management. For example, the use of blockchain technology can create a secure and transparent record of government debt transactions, reducing the risk of fraud and corruption.

Additionally, digital platforms can provide real-time access to information about government debt, allowing stakeholders to monitor debt levels and repayment schedules more effectively. However, it is important to recognize that implementing technological innovation in debt management strategies also comes with its own set of challenges. For example, there may be concerns about data privacy and security when it comes to leveraging advanced data analytics and artificial intelligence in debt management.

Additionally, there may be resistance from certain stakeholders to adopting new technologies in debt management processes. Policymakers must carefully navigate these challenges to ensure that technological innovation in debt management is implemented in a way that enhances transparency and accountability while addressing potential concerns.

Potential Risks and Challenges of Technological Innovation in Government Debt and Deficit Management

While technological innovation offers numerous opportunities for improving government debt and deficit management, it also comes with potential risks and challenges that policymakers must carefully consider. One of the key risks is related to data privacy and security. As governments leverage advanced data analytics and artificial intelligence in their debt management processes, there is a risk that sensitive financial information could be compromised if proper safeguards are not put in place.

Additionally, there may be concerns about the ethical use of technology in debt management, particularly when it comes to making decisions about borrowing and repayment based on algorithmic analysis. Furthermore, there may be challenges related to the adoption of new technologies in government debt management processes. For example, there may be resistance from entrenched interests within government agencies to change traditional debt management practices or adopt new technologies.

Additionally, there may be concerns about job displacement as certain administrative tasks become automated through technological innovation. Another potential risk is related to the rapid pace of technological change. As new technologies emerge at an increasingly rapid pace, governments must ensure that they have the capacity to keep up with these changes and adapt their debt management strategies accordingly.

Failure to do so could result in missed opportunities for improving efficiency and effectiveness in debt management.

Case Studies of Countries Utilizing Technological Innovation to Manage Debt and Deficit

Several countries around the world have successfully utilized technological innovation to manage their debt and deficit. One notable example is Estonia, which has been a pioneer in leveraging technology for various government functions. The Estonian government has implemented a range of digital solutions for managing public finances, including a secure digital platform for accessing government services and conducting financial transactions.

This has not only improved efficiency in service delivery but has also enhanced transparency and accountability in government financial management. Another example is Singapore, which has been at the forefront of using advanced data analytics and artificial intelligence in its debt management processes. The Monetary Authority of Singapore (MAS) has developed sophisticated data analytics tools to monitor systemic risks related to government debt and inform policy decisions about borrowing and repayment.

This has allowed Singapore to make more informed decisions about managing its debt portfolio while minimizing borrowing costs. Additionally, the United Kingdom has made significant strides in leveraging blockchain technology for improving transparency and accountability in government debt management. The UK government has piloted blockchain-based platforms for recording and monitoring government debt transactions, providing stakeholders with real-time access to information about debt levels and repayment schedules.

These case studies demonstrate the potential for technological innovation to significantly improve government debt and deficit management. By learning from these examples, other countries can gain valuable insights into how they can harness technology to address their own debt challenges more effectively.

Future Implications and Recommendations for Harnessing Technological Innovation in Government Debt Management

Looking ahead, there are several key implications and recommendations for harnessing technological innovation in government debt management. First and foremost, policymakers must prioritize data privacy and security when leveraging advanced data analytics and artificial intelligence in debt management processes. This includes implementing robust safeguards to protect sensitive financial information from unauthorized access or misuse.

Additionally, governments must invest in building capacity for adopting new technologies in debt management processes. This includes providing training and support for government officials to understand how to effectively leverage technology for improving efficiency and effectiveness in debt management. Furthermore, policymakers should prioritize collaboration with the private sector and academia to stay abreast of emerging technologies that could have implications for government debt management.

By fostering partnerships with external stakeholders, governments can gain valuable insights into how they can harness cutting-edge technologies for addressing their debt challenges more effectively. In conclusion, technological innovation offers numerous opportunities for improving government debt management. By leveraging advanced data analytics, artificial intelligence, blockchain technology, and digital payment systems, governments can enhance revenue generation, improve spending efficiency, inform debt management strategies, and enhance transparency and accountability in debt management processes.

However, it is important for policymakers to carefully consider potential risks and challenges associated with technological innovation in government debt management while learning from successful case studies of countries that have effectively utilized technology for managing their debt and deficit. By prioritizing data privacy and security, investing in capacity building for adopting new technologies, and fostering collaboration with external stakeholders, governments can harness technological innovation to address their debt challenges more effectively while ensuring responsible and ethical use of technology in debt management processes.

If you’re interested in learning more about how technological innovation can impact government debt and deficit management, you should check out the article “The Role of Artificial Intelligence in Public Finance” on The Econosphere. This article explores how AI can be used to improve fiscal policy decision-making and streamline government financial processes, ultimately leading to more effective debt and deficit management. It’s a fascinating read for anyone interested in the intersection of technology and public finance.

FAQs

What is technological innovation?

Technological innovation refers to the development and implementation of new or improved technologies, processes, or products that lead to advancements in various industries and sectors.

How does technological innovation affect government debt and deficit management?

Technological innovation can affect government debt and deficit management in several ways. It can lead to increased productivity, economic growth, and efficiency, which can in turn generate higher tax revenues and reduce the need for government borrowing. Additionally, technological innovation can also lead to cost savings in government operations and services, which can help in managing deficits and reducing debt.

What are some examples of technological innovations that can impact government debt and deficit management?

Examples of technological innovations that can impact government debt and deficit management include automation and artificial intelligence, which can improve productivity and reduce the need for labor-intensive tasks. Additionally, advancements in healthcare technology can lead to cost savings in healthcare expenditures, which can impact government spending and debt.

Are there any potential drawbacks of technological innovation on government debt and deficit management?

While technological innovation can have many positive impacts on government debt and deficit management, there are also potential drawbacks to consider. For example, the initial costs of implementing new technologies can be high, and there may be challenges in retraining the workforce to adapt to new technologies. Additionally, technological innovation can also lead to job displacement in certain industries, which can impact government spending on social welfare programs.

How can governments leverage technological innovation to improve debt and deficit management?

Governments can leverage technological innovation to improve debt and deficit management by investing in research and development, promoting the adoption of new technologies in public services, and creating policies that support innovation and entrepreneurship. Additionally, governments can also collaborate with the private sector to harness the potential of technological innovation in addressing fiscal challenges.